Community Support Grows for our New Down Payment Assistance Fund

Thank you for all the supportive comments on the new Chelan/Douglas Down Payment Assistance program we introduced earlier this month.

To learn about who’s giving back to our community and supporting the local Real Estate industry, please visit the Community Foundation of NCW’s webpage below:

We’re excited to share that the fund has already grown to $6,484!

FBI Report Highlights Rising Fraud—New Prevention Tools Coming in May

As we shared on Friday, the FBI released its 2024 fraud report last week, highlighting a continued rise in fraud nationwide—impacting both our industry and our communities. Notably, seller impersonation fraud has surged in the Northeast and is expected to spread. Stay vigilant, and keep an eye out for our new fraud prevention products launching in May.

Neither tariffs, rising interest rates, supply chain issues, consumer sentiment, nor national trends are slowing down the local real estate market. North Central Washington is gaining attention—both regionally and nationally.

Here are just a few examples:

- Hayden Homes, the largest homebuilder in the Northwest, is actively advertising to landowners in our region.

- In February, Century Communities, a publicly traded homebuilder based near Denver, Colorado, purchased 35 lots in Wenatchee.

- I continue to receive a steady stream of requests from Realtors located on the West Side of the state for customized property owner lists—requests we do not fulfill, as Pioneer Title is not a National company.

Chelan/Douglas Real Estate Surges as National Sales Decline

Last Thursday, the National Association of Realtors reported a 5.9% month-over-month drop in home sales nationwide—the steepest decline since interest rates spiked in 2022.

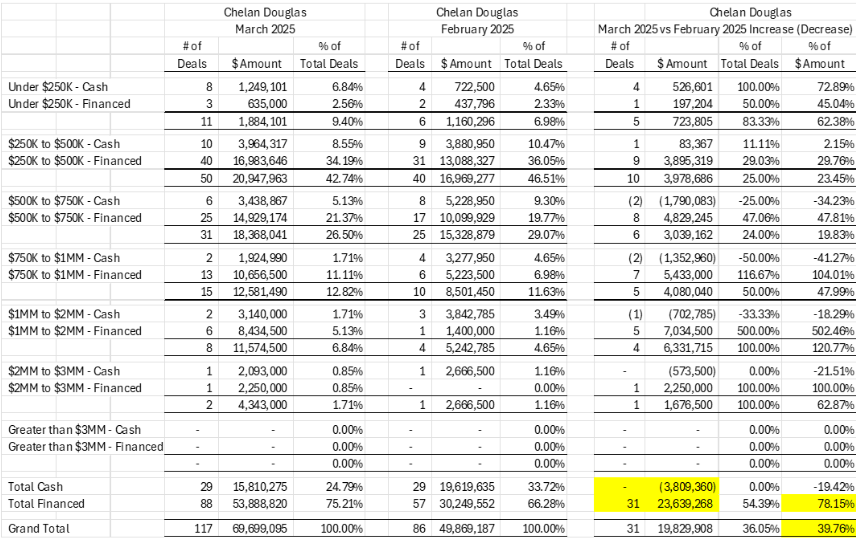

In sharp contrast, Chelan and Douglas counties continue to defy National trends. Local sales rose 36% by unit volume and nearly 40% by dollar volume compared to the previous month, with gains seen across all price ranges. Remarkably, financed transactions alone increased by $23 million over last month.

Chelan/Douglas March 2025 vs February 2025

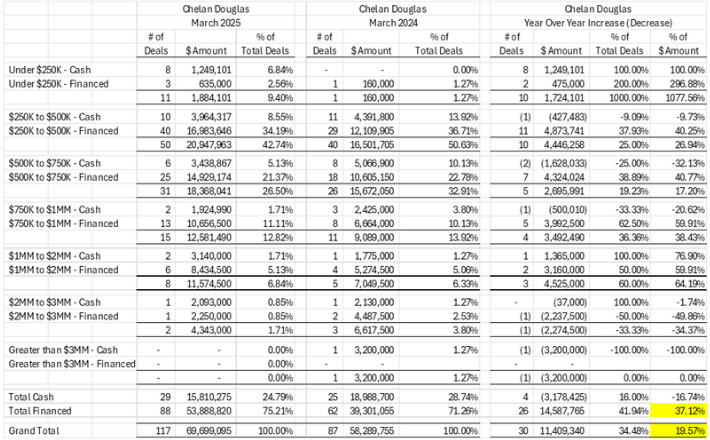

Comparing March 2025 to March 2024, we once again see a significant increase in sales volume across all price ranges, with unit volume up 34.5%. Financed transactions continued to lead the way in driving this growth.

Chelan/Douglas: March 2025 vs March 2024

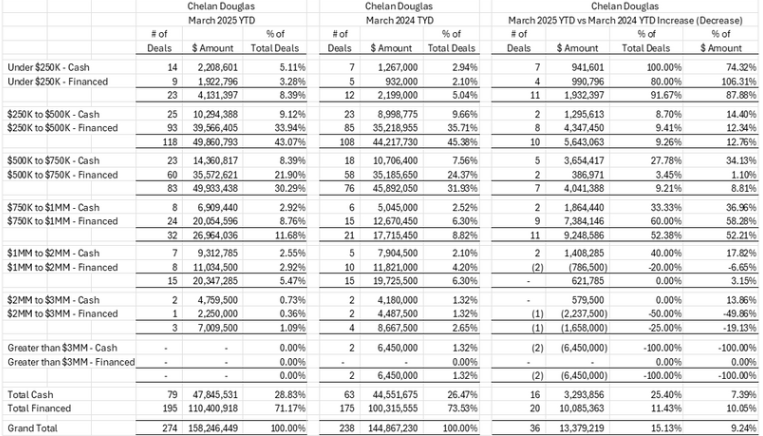

Chelan/Douglas: March 2025 YTD vs March 2024 YTD

For the quarter ended, any slowdown in January and February was more than offset by March’s strong performance. Year-to-date sales are up 15% by unit volume and 9.2% by dollar volume. Nearly all price categories contributed to the increase, with the exception of properties over $2 million.

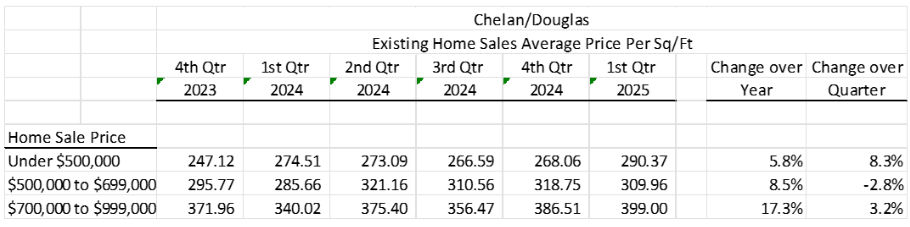

Chelan/Douglas: Average Price Per Sq/Ft

It’s been challenging to identify a firm trend in price per square foot, but it’s clear now that the under $500K category has seen an increase in price. The $500K to $700K range is still experiencing some fluctuations, while the over $1 million price range is showing a distinct upward trend. Despite ongoing economic uncertainty, April feels like it could be a big month. We’ll be watching closely to see how current challenges impact this hot market.

Exploring the Dynamic Wenatchee Market: From Entiat to Malaga, Rock Island to Orondo and West to Cashmere

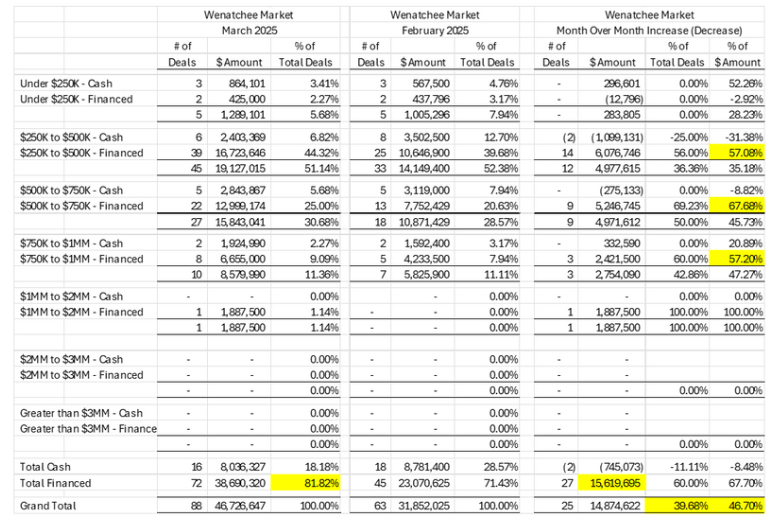

The Wenatchee market led the charge for the two-county month-over-month pop in volume, with a 40% increase in unit volume and a 46% rise in dollar volume. Nearly 82% of transactions were financed, contributing to a $15.6 million increase. Once again, we saw a healthy boost across all price ranges.

Wenatchee: March 2025 vs February 2025

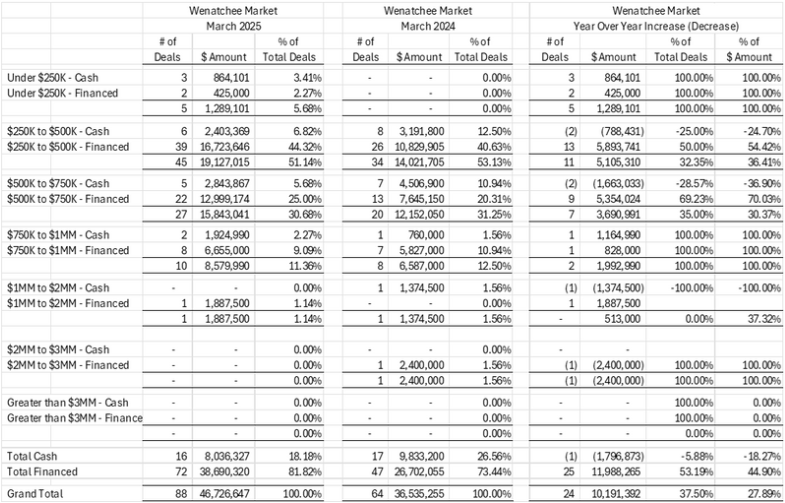

March 2025 saw a notable improvement over March 2024, with gains spread evenly across all price ranges.

Wenatchee: March 2025 vs March 2024

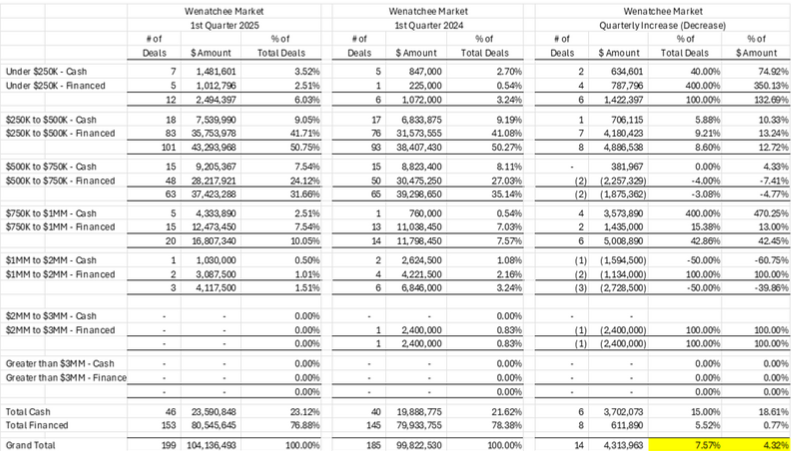

Despite a slower start in January and February, March more than made up for it, and by the end of the quarter, the Wenatchee market is outperforming last year’s strong results.

Wenatchee: 1st Quarter 2025 vs 1st Quarter 2024

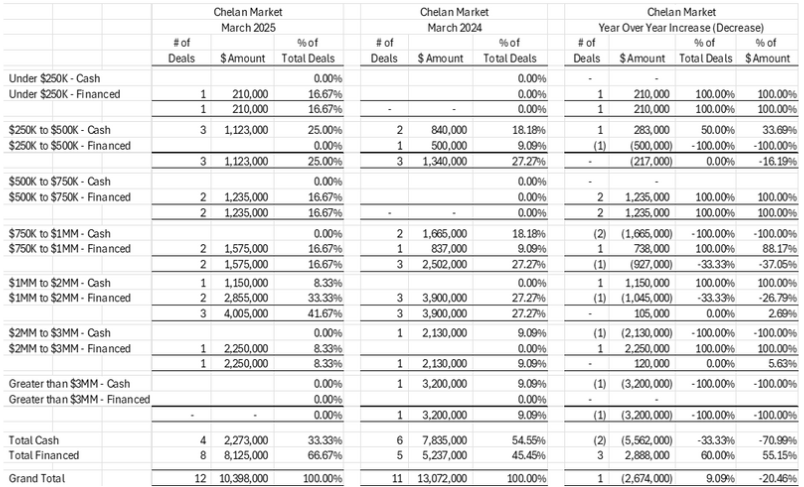

The Chelan Market: Encompassing Manson and Stehekin

Chelan’s March volume closely mirrored last year’s, with the exception of a single $3.2 million transaction. Unit volume was up by one transaction, while dollar volume declined by $2.7 million.

Chelan: March 2025 vs March 2024

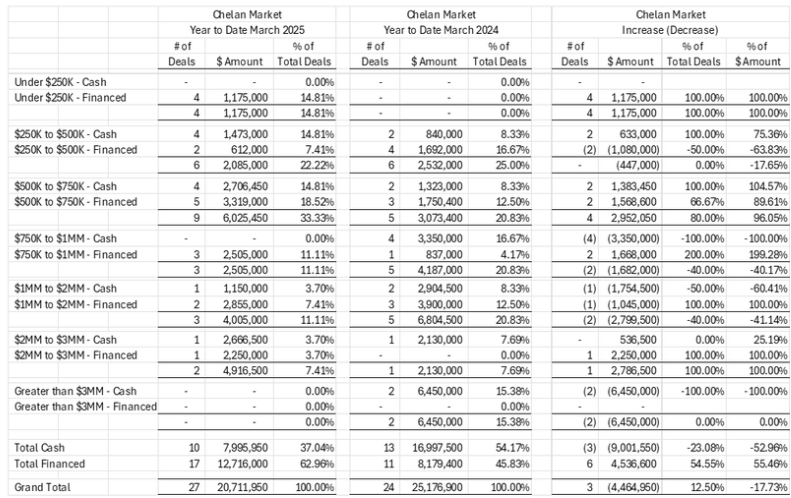

For the first quarter, Chelan is off to a steady start, though at slightly lower price levels. Transaction volume is up 12%, but overall dollar volume is down 17% compared to last year, largely due to a few $3 million deals that boosted 2024’s numbers. This year’s activity is more concentrated in the lower price ranges.

Chelan: YTD March 2025 vs YTD March 2024

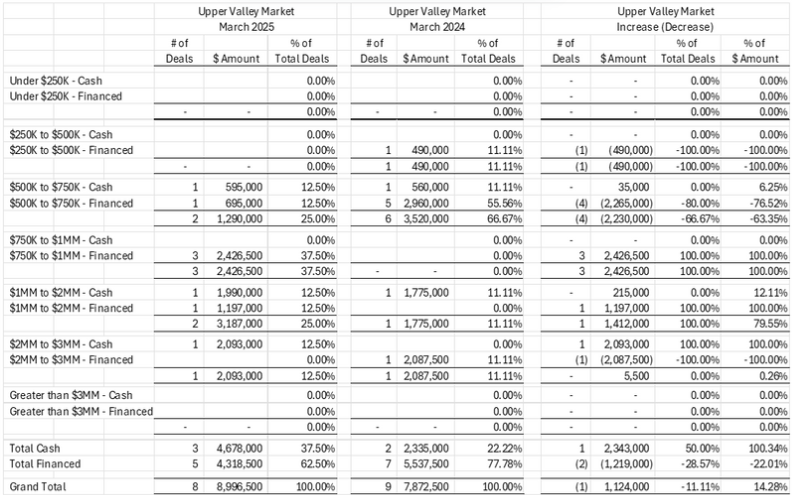

Exploring the Upper Valley Market: Insights from Dryden to Stevens Pass, Including Leavenworth, Lake Wenatchee and Plain

March saw a slight slowdown in the Upper Valley, which had been off to a strong start in 2025. There was one fewer transaction this March compared to the same time last year.

Upper Valley: March 2025 vs March 2024

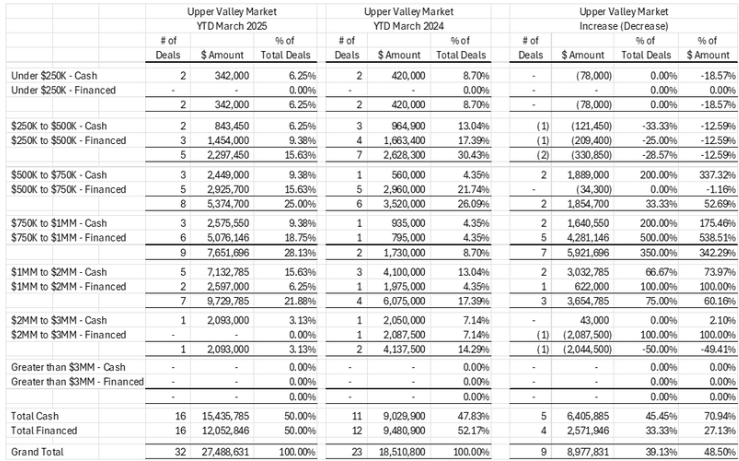

However, thanks to strong activity in January and February, the Upper Valley remains well ahead of last year, with transaction volume up 39% and dollar volume up 49%.

Upper Valley: YTD March 2025 vs YTD March 2024

Stay Connected!