Happy New Year from Pioneer Title Company!

The

holidays are over and that means it’s time for us all

to get back to work.

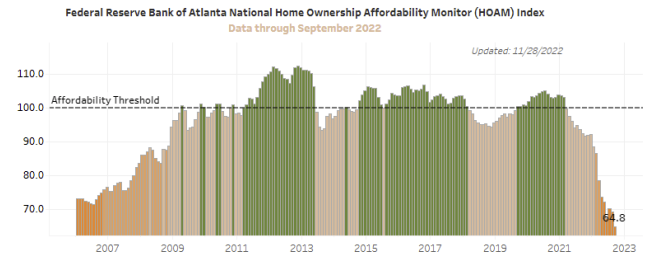

Its not news that the general consensus is that 2023 will be a difficult year in real estate. The rapid rise in interest rates has not been this drastic since the last meaningful recession of the early 1980s. As we pointed out in the last couple of newsletters, that crimp in affordability has had its impact at the lower price ranges.

As prices decline, we want to provide you with data. Our goal is to help you stay alert on current pricing conditions so that expectations can be adjusted accordingly. Lyda and I spent a considerable amount of time over the last week analyzing national pricing data as well as compiling local data.

Its not news that the general consensus is that 2023 will be a difficult year in real estate. The rapid rise in interest rates has not been this drastic since the last meaningful recession of the early 1980s. As we pointed out in the last couple of newsletters, that crimp in affordability has had its impact at the lower price ranges.

As prices decline, we want to provide you with data. Our goal is to help you stay alert on current pricing conditions so that expectations can be adjusted accordingly. Lyda and I spent a considerable amount of time over the last week analyzing national pricing data as well as compiling local data.

In Tuesday’s edition of the Seattle Times, it was reported that Moody’s Redfin and Wells Fargo expect prices to fall nationally between 4% to 5.5%. Here is what other experts think: Experts Predict What The Housing Market Will Look Like In 2023

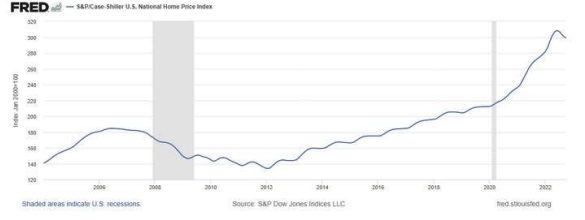

Here is a look at the S&P/Case-Shiller U.S. National Home Price Index for 2000 through

2022. What we see is both the formation and release of the bubble in the 2000s looking

a bit “gentler” than it felt in 2007-09, and that the one beginning in 2020 looks much

more dramatic.

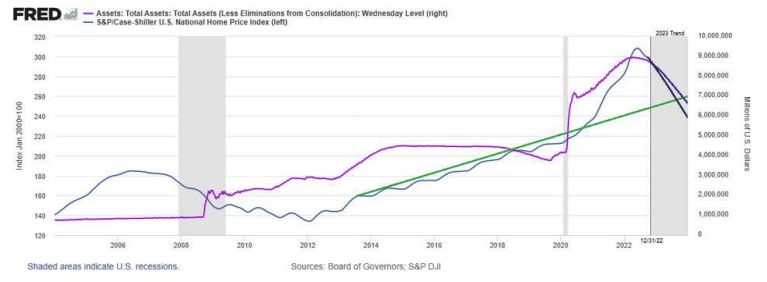

The next graph is the balance sheet of the Federal Reserve. Note that this is in “trillions”

of dollars. This tracks the amount of assets the Fed holds, most in Treasury Securities

and Mortgage Backed Security (MBS). When the Fed buys assets, it injects liquidity in

the market, as it prints dollars to buy those assets.

Next we overlaid the two graphs and added some trend lines. The blue line is the

national home price index and the purple line is the Fed’s injection into the economy.

We also added a green line of the more gradual trend that housing prices were on and

where that line was heading into 2023/24. Note how home prices react to the injection

from the Fed. There is definitely a parallel curve. During the 2nd half of 2022 you can see

the home prices and the Fed’s reduction of liquidity moving in unison. The Fed’s current

plan is to reduce liquidity by $95 billion per month. Our research indicates many

economists think the Fed hopes to get their balance down to $7 trillion in 2023.

IF the Fed is able to get their balance sheet down to $7 trillion without the market seizing due to illiquidity, based on the shape of the graphs and the green trend line that house prices were on prior to the injection, we think there is an argument to be made that by the end of 2023 or early 2024, prices could fall by 25% on a national basis.

Reminder, this information is based on national home prices along with central bankers who tend to make mistakes and change their mind. But this is something we will want to keep our eyes on as the year progresses.

IF the Fed is able to get their balance sheet down to $7 trillion without the market seizing due to illiquidity, based on the shape of the graphs and the green trend line that house prices were on prior to the injection, we think there is an argument to be made that by the end of 2023 or early 2024, prices could fall by 25% on a national basis.

Reminder, this information is based on national home prices along with central bankers who tend to make mistakes and change their mind. But this is something we will want to keep our eyes on as the year progresses.

Here is a look at what SALES prices have done locally over the last eleven months. This is a compilation of a blended average and median price per square foot for homes in the ranges provided by quarter.

What we see is that prices continued to increase throughout most of 2023 and are

now starting to crest. Note that prices per square foot inside each range can vary

by hundreds of dollars.The purpose of this schedule is not to support specific prices

per square foot, but rather to show a trend. If you would like to see detail of existing

sales in a range during a specific period, we have that info available at our finger tips.

The Good News

Now for the good news! Psychologically, millennials have not given up on buying a

home. While affordability isn’t “there” yet, 95% of millennials DO want to own their

own home. An article from PropertyManagement.com shows how many millennials

have moved in with their parents in the past year, and how current renters have high

hopes to own their own homes. Unfortunately, 44% of millennial renters surveyed

could only afford a house with a mortgage rate of 3.5% or less. With current rates

between 6-7%, this is a substantial hurdle.

This is all GREAT news and an incredible future market for those that want to play the long game. And when prices come down, this segment of the population needs to be ready to pounce, which means they need to develop relationships with agents and lenders that want to work with first time home buyers. Sometime in January our Geo Farming product is expected to start providing renter information, and you can bet we will be investing in marketing to this segment.

Until prices come down to the point the first time buyers can jump, there is another segment we can focus on: Downsizers. In Chelan County we have 1,130 homeowners that have owned their home for at least 30 years and they don’t appear to have a mortgage balance.

Downsizing in a sellers market may not be perfect, but this market is different than any other we have had in 40 years. The “pop” in the bond market bubble has provided safe investment opportunities with a real yield that we haven’t had since the 1980s. If someone can downsize and pick up $200,000 of cash, and invest with a 6% rate of return, they have now added $1,000 of income per month to their income.

We are working to provide you with even more data about sales in 2022 with December’s information coming in the next few days. We will also soon have renter information available to us for those who are ready to market to those hopeful potential buyers! Stay tuned!

This is all GREAT news and an incredible future market for those that want to play the long game. And when prices come down, this segment of the population needs to be ready to pounce, which means they need to develop relationships with agents and lenders that want to work with first time home buyers. Sometime in January our Geo Farming product is expected to start providing renter information, and you can bet we will be investing in marketing to this segment.

Until prices come down to the point the first time buyers can jump, there is another segment we can focus on: Downsizers. In Chelan County we have 1,130 homeowners that have owned their home for at least 30 years and they don’t appear to have a mortgage balance.

Downsizing in a sellers market may not be perfect, but this market is different than any other we have had in 40 years. The “pop” in the bond market bubble has provided safe investment opportunities with a real yield that we haven’t had since the 1980s. If someone can downsize and pick up $200,000 of cash, and invest with a 6% rate of return, they have now added $1,000 of income per month to their income.

We are working to provide you with even more data about sales in 2022 with December’s information coming in the next few days. We will also soon have renter information available to us for those who are ready to market to those hopeful potential buyers! Stay tuned!