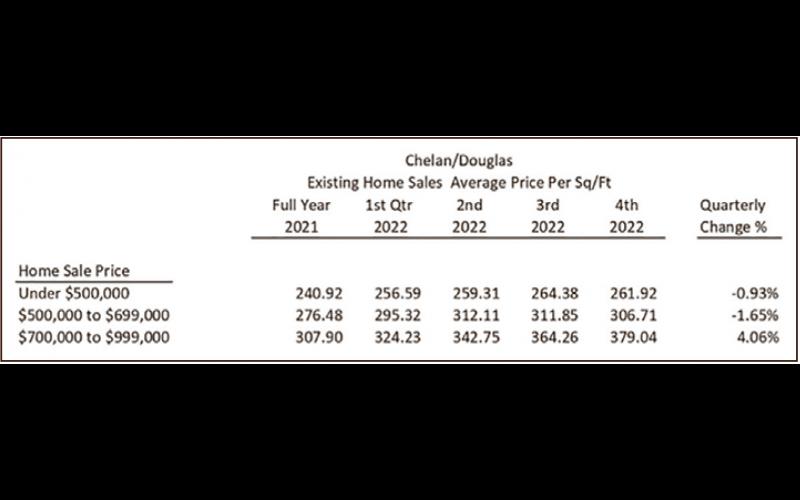

The National Association of Realtors announced on February 21 that existing home sales had slowed in January for the 12th month in a row. Locally, the Chelan/Douglas market was also stung by slower sales, although the data clearly shows interest rates are the culprit. While single family home sales fell by 30% compared to January of a year ago, cash purchases increased by 65% while financed transactions fell by 41%. British Investor Jeremy Grantham has an excellent track record at identifying “bubbles” just before they begin to burst. The following is a link to his investment newsletter published on January 24. After a Timeout, Back to the Meat Grinder! (gmo.com). Mr. Grantham points out that the burst of the housing bubble has just begun, and that the last bubble began to pop in 2006 and didn’t bottom out until 2012. He further emphasizes that housing bubbles are slower to react and take longer than bond and equity markets to hit bottom. That is currently the case for the Chelan/Douglas housing market. While sales have slowed, prices have held fairly firm, and have only recently started to crest. The following table is our analysis of the sales price per square foot to give certain price ranges.

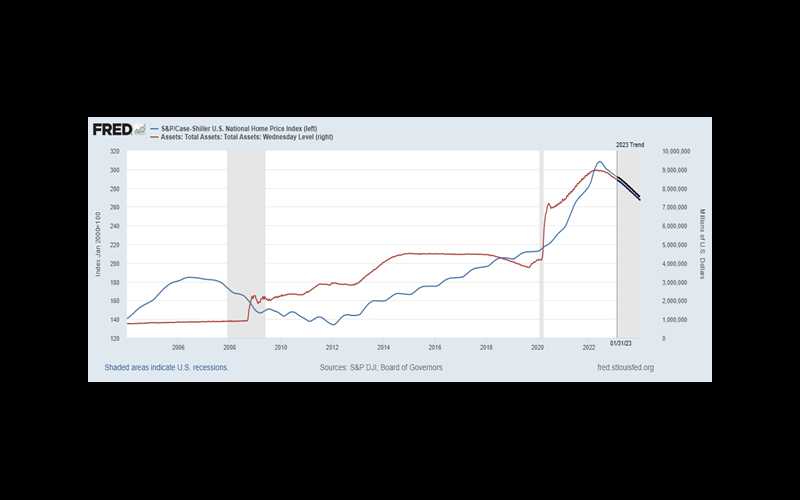

As Mr. Grantham states, all bubbles are different and have their unique characteristics. What worries me about this particular bubble is that it was obviously created by the Federal Reserve and its post Covid liquidity injection. As the graph below illustrates, the unprecedented $5 trillion in asset purchases by our Central Bank in 2020-21 parallels the rise in home prices into 2022. In June of 2022 the Federal Reserve reversed course and began its “Quantitative Tightening” period to shrink its Balance Sheet, meaning reduce the liquidity in the system. Housing prices soon reversed course as well. As the Fed pricks this bubble, the beginnings of this burst, especially as we draw in the continuations of its 2023 trend line, has a much more dramatic look to it than the 2006 bubble. See the “hook” at the top of the blue line. Pictures start to tell a scary story and the potential of this one has a tendency to keep me awake at night.

But there is some good news. While existing home sales have fallen, the sales of new homes increased in January (nationally) for the second month in a row. Locally, our office and other offices I have spoken with report an uptick in activity for February. Sales in February and March will give us a clearer picture of whether prices have held. What I have been telling my mom, and anyone nearing or in their retirement years, is that now is the time to downsize their home. In addition to prices staying mostly firm, the return rates on fixed income investments is something we haven’t seen in decades. FINALLY, savers are being rewarded. If someone can downsize and transfer their previously untapped home equity into a $200,000 fixed income investment with a safe 6% yield, that’s an extra $1,000 per month in cash flow. Mom, now’s the time.

Brian Fair is the owner of Pioneer Title Company located in Chelan and Wenatchee. He can be reached at (509) 663-1125 or brian@pioneertitlecompany.com

Written by: Brian Flair