Happy Holidays from Pioneer Title Company!

We are seeing more and more interest in our Geo product for farming with agencies requesting presentations, and that’s encouraging, but there is still the overall sense that marketing in December is not the best or most desirable thing people want to do right now. So we are saving a lot of our thoughts and ideas for January. Consider this newsletter, December “light”.

As you start thinking about the new year and making plans and resolutions, consider a heavier social media presence and direct marketing campaign. See links to more tips on pg. 4!

All of us at Pioneer Title Company hope you have a wonderful holiday season!

Welcome Teddie Shales & Leti Mendez to the Pioneer Title Company Team!

Consider joining your clients at their signings!

Why has our market slowed down? Here is what Bloomberg tells us.

Two towns on either side of the country have risen fastest up the rankings of America’s costliest places to live over the past dozen years, according to data published by the Bureau of Economic Analysis Thursday.

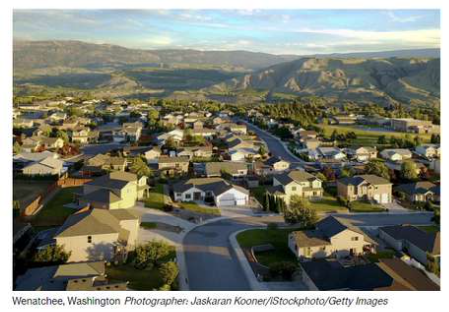

At the start of last decade, Wenatchee, Washington was around the middle of 389 US metro areas ranked by price level — but by last year it had become the 36th most expensive city in the country, according to the bureau’s latest data on regional price parity.

The second-biggest climber is The Villages in Florida, a massive retirement community where prices have likely been lifted — relative to the rest of the country — by an inflow of people seeking housing and goods. Measured by state, the most expensive places to live last year were Hawaii, California, and New York — and the cheapest were Mississippi, Alabama and Kentucky.

San Francisco remained the most expensive US city last year, and has held the top spot since 2018. New York City, the nation’s second-priciest metro area before the pandemic, has now dropped to fourth place.

The price gap between San Francisco and the rest of the country has at least narrowed a little. Prices were 22% higher than the US average in 2018; now the difference is down to 20%.

Here's what we know!

Sales have dropped 31% in terms of raw deal flow, same as October 2022 vs. October 2021, yet dollar volume went up by $9MM, or 9%. The dollar volume was helped significantly by the $10MM sale of a compound on Lake Chelan near Manson.

- There is a significant drop in the transaction range of $250K to $500K. There were 38 fewer closings in this price range compared to November 2021.

- Chelan County had 14 deals of over $1,000,000 (excluding the 10.5MM Manson deal)

- The ratio of cash sales to financed has crept up another 5% greater than the year before

What else happened in November other than Single Family home sales?

- 10 mobile homes (with land) sold for $3,960,257

- 9 condos sold for $4,018,199

- 9 Commercial (non Ag) deals for $8,920,000

- 3 large land deals for $8,833,045

- 28 deals for other land, lots, and Ag not in service for 7,735,817

- 14 Personal Representative Deeds filed covering 22 parcels