Housing Market Data

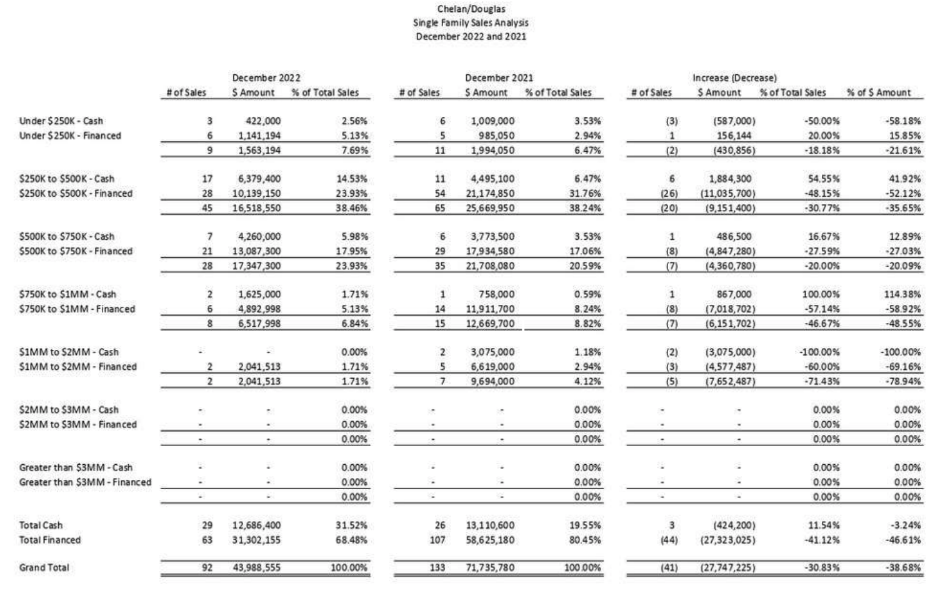

We ended the year with a rocky December, which

isn’t uncommon for the winter months, but this

was an especially difficult 4th quarter for the

housing market. The drop in year over year sales

volume for December was 30% in terms of deal

flow, but 38% in terms of dollar volume. The

culprit was simply interest rates, as cash deals

increased by 11% while financed deals fell by

41% year over year. Financed deals went from

80% in 2021 to 68% in 2022.

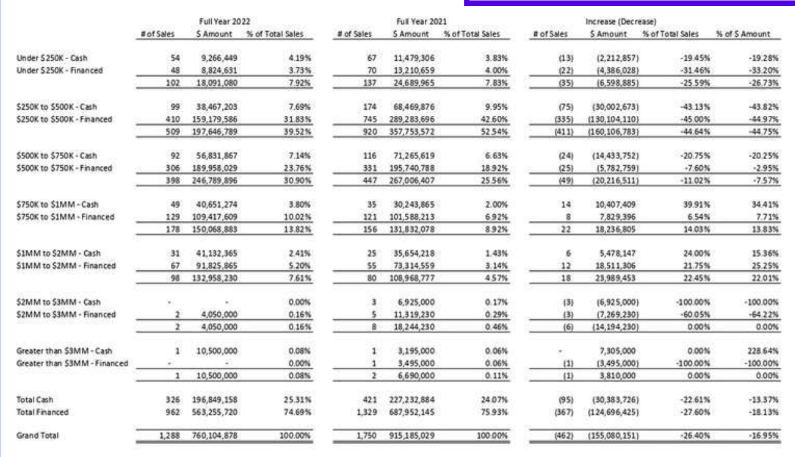

Year over year we see a 26% drop in deal flow and 17% in dollar volume. Consistent with what we have seen the last few months, the beating has been the < $500,000 price range.

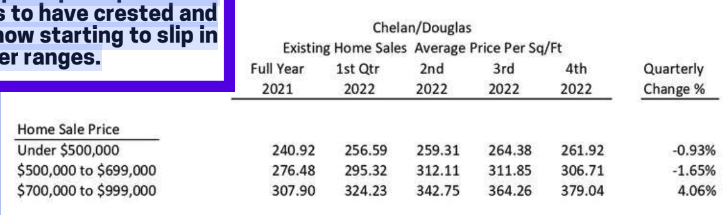

As we reported earlier this month, price per square foot appears to have crested and is just now starting to slip in the lower ranges.

Here's Some Double Speak

Alan Jope, CEO of consumer products behemoth Unilever, holding

forth to CNBC on Tuesday morning from Davos, Switzerland:

“We know for sure there’s more inflationary pressure coming

through in our input costs. We might be, at the moment, around

peak inflation, but probably not peak prices.”

What else happened in December other than single family?

- Mobile homes (with land) sold for

- $1,485,500

- 4 Condos sold for $1,350,000

- 3 Time Shares for $12,950

- 8 Commercial (non Ag) sales for $8,174,618

- 2 large land sales for $6,300,000

- 30 sales for other land, lots, and Ag not in

service for $7,341,829 - 19 Personal Representative Deeds filed covering 23 parcels

- 1 Multi Family for $650,000